With Citibank online login India, customers in India get access to a world of financial convenience from the comfort of their home or office. Let’s explore this remarkable service.

The Power of Citibank Net Banking

Citibank, a name synonymous with financial excellence, understands the need for efficient banking solutions. This platform offers an array of features that make managing finances a breeze, from Citibank credit card login India to fund transfer and balance inquiry.

Services Offered by Citibank Net Banking

Citibank’s Net Banking platform is a treasure trove of services designed to meet the diverse needs of its customers in India. Let’s explore these services:

Citibank’s Net Banking platform is a treasure trove of services designed to meet the diverse needs of its customers in India. Let’s explore these services:

- Fund Transfer: With Citibank online login India, you can effortlessly transfer funds to any account, whether it’s with Citibank or another bank in India. The comfort of exchanging cash online from the comfort of your home or office could be a game-changer for busy

- Tax Payment: You can make hassle-free tax payments through Citibank’s online platform. Say goodbye to long queues and complicated processes. Citi’s credit card login portal streamlines the entire tax payment experience.

- View Transaction History: Keeping track of your financial transactions is crucial. Citibank Credit Card Login India lets you view your transaction history, helping you stay on top of your financial commitments.

- Cheque Book Issuance: Need a new checkbook? Ordering one is a breeze with Citi India login through net banking. Save time and effort with this simple online request.

- Bill Payment: Settle your utility bills with ease through Citibank’s online bill payment feature. Say farewell to the days of paper bills and late payments.

- CitiAlerts (Account Alerts): Stay informed about your account activity by setting up a Citi credit card login. Receive timely notifications on your mobile device or via email.

- Link Multiple Accounts: Manage multiple accounts effortlessly by linking them within the Citi cards login net banking portal. This feature simplifies the process of monitoring your financial portfolio.

- Review/View Bills Online: Access and review your bills online. No more sifting through piles of paper documents; everything you need is available at your fingertips.

- Order Demand Drafts: If you require a demand draft, Citibank makes it easy to order one online, saving you a trip to the bank.

- Open/Close Online FD: Manage your fixed deposits online, whether you want to open a new one or close an existing FD.

- Transfer Funds – NEFT/RTGS/IMPS: Choose the most suitable fund transfer method. Citibank supports NEFT, RTGS, and IMPS for your convenience.

- Repay Home Loan: If you have a Citibank home loan, you can conveniently make repayments online through Citi bank login India No more standing in long lines at the bank.

- Access Personal Loan Details: Get all the information you need about your Citibank personal loan with a few clicks.

- Pay Utility Bills: Never miss another utility bill payment. Pay your bills online and enjoy the convenience of automated transactions.

- Balance Enquiry: Keep tabs on your account balance from the comfort of your home or office. Citibank online login in India makes it effortless.

- Sign up for eStatements: Reduce paper clutter by signing up for eStatements. Access your statements online and contribute to a greener environment.

- View, Buy, Sell Mutual Funds: Investing in mutual funds is simplified through Citibank Net Banking. Access, purchase, and sell mutual funds with ease.

- Services and Support Centre: If you have any queries or require assistance, Citibank’s online support center is readily available to help you with your banking needs.

- Online Shopping: Online shopping has become an integral part of modern life. With Citibank online login India, you can make secure online purchases with your credit card.

- Online Ticket Booking: Whether it’s flight tickets, movie tickets, or event tickets, you can conveniently book them through Citibank Net Banking.

- Change Account Details: Update your account information as needed, whether it’s a change of address, contact details, or any other pertinent information.

- Access Spend Analyser: Get insights into your spending patterns and habits. Analyze your money-related information to make an educated

- Hotlist Credit/Debit Cards: In case of a lost or stolen card, you can take immediate action by hotlisting your credit or debit card through Citibank Net Banking login.

- Apply for Insurance: Explore and apply for insurance products that suit your needs, all within the Citibank Net Banking

How to Register for Citibank Net Banking

How to Register for Citibank Net Banking

Getting started with Citibank Credit Card Net Banking is a straightforward process. Here’s a step-by-step easy manual to help anyone register and figure out their Citibank login:

Getting started with Citibank Credit Card Net Banking is a straightforward process. Here’s a step-by-step easy manual to help anyone register and figure out their Citibank login:

- Step 1: Go to Citibank’s official website and click on the “Log in now” option.

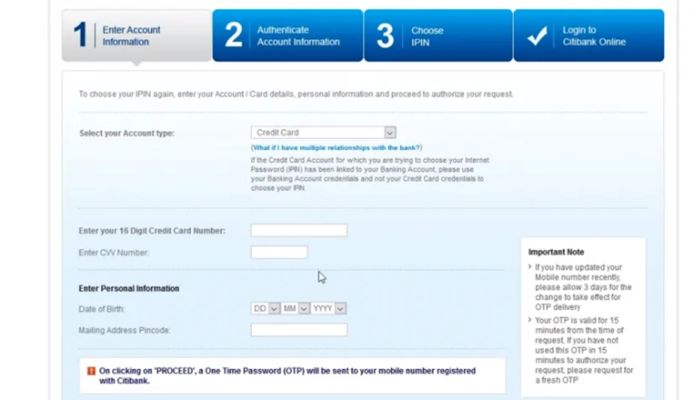

- Step 2: On the next page, select “First time user? Register.” From the account data dropdown, select “credit card” and enter your Citibank credit card subtle elements, including your card number, CVV, and date of birth. Click “Proceed.”

- Step 3: Authenticate your account and card details by entering the OTP (Time Password) received on your registered mobile number.

- Step 4: Choose a confidential and secure user ID and password, and you’re ready to log into your Citibank Net Banking account.

After successful enlistment, you’ll log into the Citibank Net Banking login portal utilizing your Citi login India ID and password, picking up access to a wide run of budgetary and non-financial exchanges and an assortment of banking services given by the bank.

How to Transfer Funds Through Citibank Internet Banking

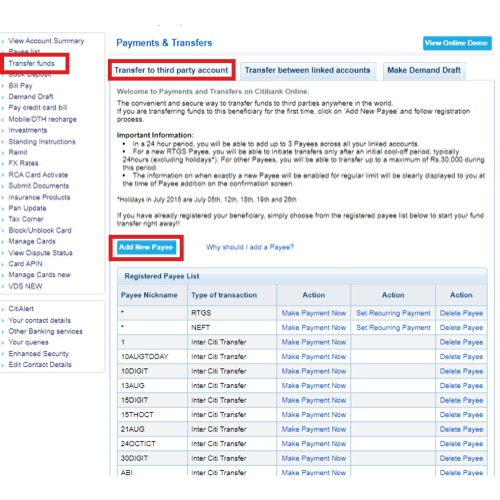

Citibank offers different helpful modes of online finance exchange, making it simple for you to send cash to anybody, anytime. Whether you’re utilizing Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT), or Real Time Gross Settlement (RTGS), Citibank gives you secure and productive support exchange options.

Citibank offers different helpful modes of online finance exchange, making it simple for you to send cash to anybody, anytime. Whether you’re utilizing Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT), or Real Time Gross Settlement (RTGS), Citibank gives you secure and productive support exchange options.

IMPS (Immediate Payment Service)

Immediate Payment Service (IMPS) may be a finance exchange benefit that permits clients to exchange cash online utilizing their enrolled mobile number. This service is accessible 24/7 and offers immediate confirmation of the transaction:

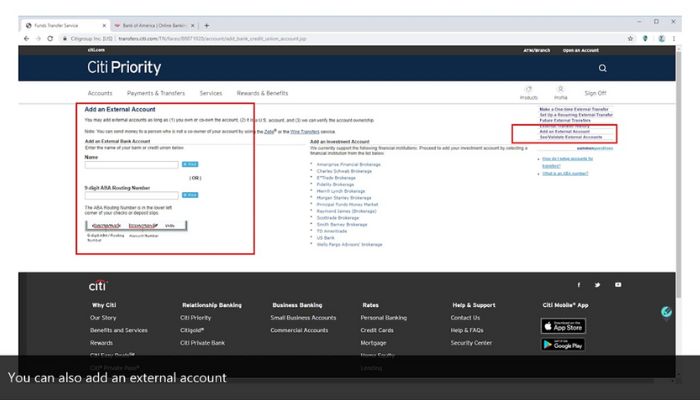

- Sign in on Citi login India, and add a payee using the Citibank account number and IFSC code.

- Click on the “Banking” tab and select “Transfer Funds” from the sidebar.

- Click on “To Other Bank Account” and then “Make Payment Now” in front of the payee’s name.

- Select the “Immediate Transfer (IMPS)” mode.

- Choose the account, input the amount, and press “Continue.”

- Accept the Terms and Conditions and press “Confirm.”

ALSO READ -HDFC BANK – CREDIT CARD APPLICATION STATUS ONLINE 2023

What are the Transfer Limits under Citibank’s Net Banking Facility?

It’s essential to be aware of the transfer limits when using Citibank Net Banking login. The daily transaction limits for various payment modes are as follows:

- IMPS: Up to Rs. 2 lakh

- NEFT:

- For CPC (Citigold Privilege Customers) and Citigold Customers: Up to Rs. 50 lakh

- For other Citibank customers: Up to Rs. 15 lakh

- RTGS: The minimum transfer amount is Rs. 2 lakh

- For CPC and Citigold Customers: Up to Rs. 50 lakh

- For other Citibank customers: Up to Rs. 15 lakh

These limits ensure the safety and security of your transactions while offering flexibility in managing your funds.

How to Reset Citibank Net Banking Password?

Forgetting or needing to reset your Citi card login is very common and it can be done anytime. Citibank services make it simple for anybody to regain a pass to their account. Here’s how you can reset your Citibank Net Banking login and password easily:

Forgetting or needing to reset your Citi card login is very common and it can be done anytime. Citibank services make it simple for anybody to regain a pass to their account. Here’s how you can reset your Citibank Net Banking login and password easily:

- Step 1: Visit the internet banking website of Citibank and click on the “Forget PIN?” option.

- Step 2: On the next page, select “Card” from the account information dropdown and enter your credit card details, including the card number, CVV, and date of birth. Click “Proceed.”

- Step 3: You will receive an OTP on your registered mobile number after completing the above step.

- Step 4: Enter the OTP and set up the new IPIN (Internet Personal Identification Number) as per the instructions provided.

- Step 5: After completing the above steps, a success message will be displayed on the screen. You can continue to log in to your Citibank Net Banking account along with your latest

How to Start a Savings Account With Citibank Online

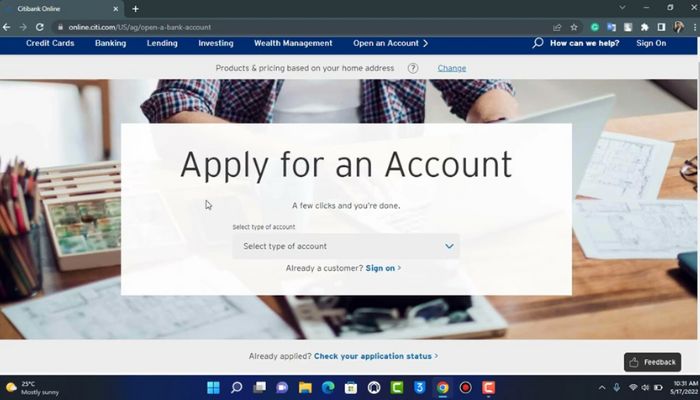

Citibank offers a simple and sorted procedure for opening a savings account online. Here’s how anyone can start with Citibank login:

Citibank offers a simple and sorted procedure for opening a savings account online. Here’s how anyone can start with Citibank login:

- Log into the bank’s “online savings account opening portal.”

- Fill out the Citibank Savings Account opening form correctly.

- After submitting the duly filled form, the bank processes the request to open a new savings account.

- Users can check the status of their savings account opening application through the portal.

- If the form cannot be filled the first time, the portal allows users to continue filling the form from where they left off.

- Opening a Citibank savings account online offers unparalleled convenience, saving you time and effort.

How to Check Citibank Account Balance Using Net Banking

Knowing your account balance is essential for effective financial management. With Login Citi, checking your account balance is a breeze. The process is as follows:

Knowing your account balance is essential for effective financial management. With Login Citi, checking your account balance is a breeze. The process is as follows:

- Log in to Citibank Internet Banking using your user ID and IPIN.

- Go to ‘My Account.’

- Select ‘Account Balance.’

Your outstanding total will be shown on another screen, giving you real-time data on almost all your money-related health.

Features of Citibank Net Banking

Citibank’s Net Banking isn’t around overseeing your account; it comes with plenty of highlights that improve your general banking encounter. Here are a few of the standout highlights of Citibank Net Banking:

- Online Bill Payment: Make payments to virtually anyone in the U.S. anytime. Moreover, receive bills electronically, instead of by mail, then view, pay, and manage them online.

- Account Alerts: Set up account updates for your Citibank credit card online login and linked Citi Credit Card accounts. These alerts can be conveyed to your mobile phone or e-mail, guaranteeing that you remain educated about your budgetary

Virtual Account Numbers: Generate Virtual Account Numbers that can be used to help protect your identity when shopping online. This highlight upgrades the security of your online transactions.

Conclusion

Citibank’s credit card online login entrance is more than just a benefit; it’s a portal to a world of comfort, effectiveness, and budgetary empowerment. So, on the off chance that you are a Citibank client, do not miss the opportunity to investigate the world of Citibank credit card India.

In a world where time is of the substance, Citibank Credit Card Net Banking offers you the valuable blessing of time, permitting you to manage your funds productively and helpfully. So, go ahead, log in to the Citibank credit card India login portal, and set out on a journey of money-related empowerment like never before. It’s time to make your financial life simpler, smarter, and more secure with Citibank.

Explore the world of possibilities with Citibank Credit Card Net Banking. Login to Citi today and experience the future of banking in India.

Add Comment