Yes, several user-friendly apps help you transfer money from a credit card to a bank account. But on every transaction, there will be a platform fee that will be charged. To save you from extra charges we bring you the best the zero charges yet extra effective and easy money transferrable Pay on Credit App by Housing. Here is what you will learn and how it will you easily transfer money from your credit card to your bank account.

Advantages of Using Apps Pay on Credit App to Transfer Money from a Credit Card

Using apps to transfer money from a credit card to a bank account offers several advantages:

- Convenience: Apps provide a convenient way to transfer money anytime, anywhere, using your smartphone or computer. You can initiate transfers with just a few taps or clicks, eliminating the need to visit a bank or ATM.

- Speed: Transfers via apps are often processed quickly, with funds typically appearing in your bank account within minutes or hours, depending on the app and your bank’s processing times. This can be particularly useful in urgent situations when you need access to funds immediately.

- Accessibility: Apps are accessible to anyone with a smartphone or internet connection, making them suitable for people who may not have easy access to traditional banking services. Additionally, many apps support multiple currencies and international transfers, enhancing accessibility for global transactions.

- User-Friendly Interface: Most money transfer apps are designed with user-friendly interfaces, making them easy to navigate and use, even for individuals who are not tech-savvy. They often offer features like transaction history tracking, customizable notifications, and in-app customer support for a seamless user experience.

- Security: Reputable money transfer apps employ advanced security measures to protect users’ financial information and transactions. These may include encryption, two-factor authentication, biometric authentication (such as fingerprint or face recognition), and fraud detection systems, providing peace of mind for users.

- Cost-Effective: Some apps offer competitive exchange rates and low or no fees for transferring money between credit cards and bank accounts. Compared to traditional methods like wire transfers or cash advances, using apps can be more cost-effective, especially for domestic and international transfers.

Overall, using apps to transfer money from a credit card to a bank account can offer convenience, speed, security, and cost-effectiveness, making them a preferred choice for many individuals and businesses alike.

Transfer Money from Credit Card to Bank Account With Pay on Credit App

Step 1: Install the App

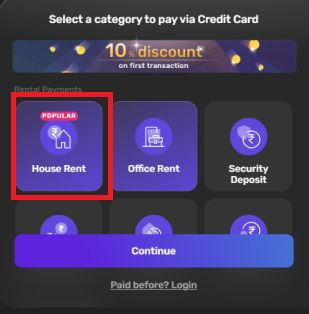

Step 2: Choose a Category

As you install the app register with your phone number, and you can directly start your transaction with the list of categories. One like education fees option to transfer your money from a credit card to a bank account.

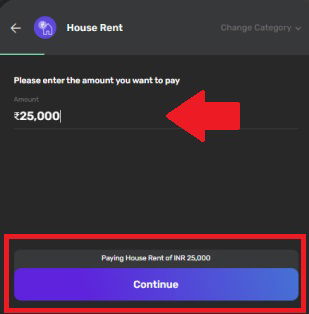

Step 3: Enter the Required Amount Based on your Credit Limit

As you select your category for a transaction, enter the amount of requirement and click on continue.

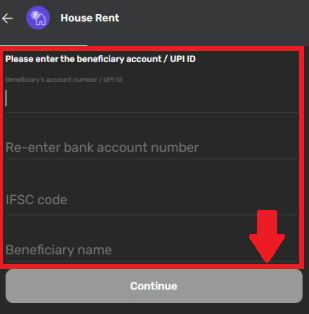

Step 4: Fill in the Details

Fill in the bank details of the person or your other account for which you want to send the money too – account number/upi ID, IFSC code, and beneficiary name to continue with the next step.

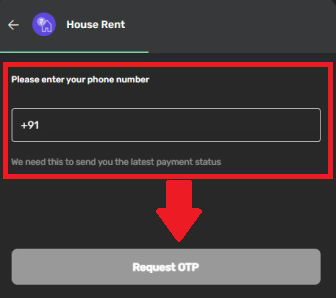

Step 5: Registered Number Verification

Add your registered bank phone number request OTP, and complete the verification process. After this, you need to add your name and then click on pay. And successfully your money from your credit card will be transferred to the respective bank account.

With Below Steps Save Extra on Your Transfer using Pay on Credit Via PaisaWapas

- Select “Pay on Credit”

- Choose “Education Fee” for a 50% discount.

- Enter your amount & bank details.

- Enter credit card details & Apply Code- PAISAWAPAS (Must to get cashback)

- 50% Fee Cashback on the First Transaction + the remaining 50% you will receive as Cashback in the App Wallet (Which can be utilized in the Next Transaction)

- And also earn a chance to win scratch card rewards.

Important Note:

- Use Only Master card/Visa/Amex (Conv Fees is 1.6%)

- Do use Ru pay Credit Cards (Conv Fees is 4% )

Frequently Asked Questions

1. Can I transfer a large amount of money from my credit card to my bank account?

Yes, you can typically transfer a large amount of money from your credit card to your bank account, but check limits and fees.

2. Are there any fees charged with transferring money from a credit card to a bank account?

Yes, fees may apply when transferring money from a credit card to a bank account, including transaction fees and cash advance fees.

3. Which is the best app to allow transferring credit card balances to a bank account?

Pay on the credit app is the best app that will allow you to transfer credit card balances to a bank account.

Add Comment