Paytm is without a doubt the most widely used online payment platform. During the demonetization era, its popularity surged, and it became the first alternative for all ordinary people.

Cashback deals are one of the most important factors contributing to the increasing consumer base. With Paytm Coupon Codes, you can save money on anything from smartphone recharges to plane and bus tickets. Paytm money can be credited to your bank account, along with the cashback you get.

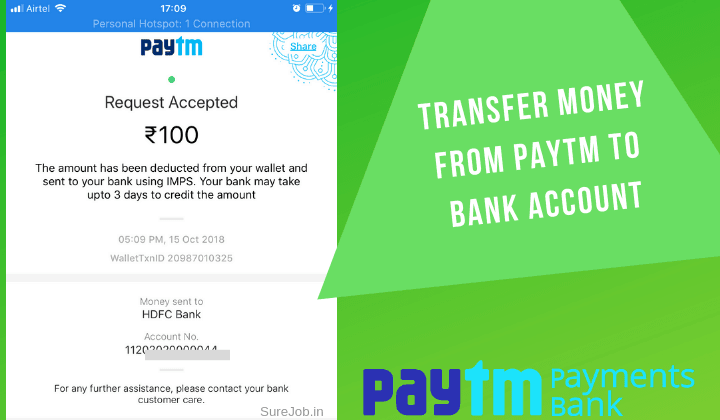

Transferring money from your Paytm wallet to your bank account is easy, and you can transfer money to the bank without incurring any additional fees.

This guide will show you how how to transfer money from Paytm to bank account free without incurring any fees.

Transfer money from Paytm to bank

Step 1: If you haven’t done so already, start by downloading the Paytm app on your phone. Both transfers are simplified when you have the app on your device. You can only access the app after you’ve downloaded and installed it.

Step 2: Launch the app. The menus should be visible inside the program. There are a lot of features and things you can do on those lists. To access your Paytm Wallet, click on “Passbook.”

Step 3: To access your Paytm account, press the Login button.

Step 4: After logging in, select “Send Money to Bank” from the drop-down menu.

Step 5: Complete the form by entering the account holder’s name, account number, the amount you want to submit, and the bank’s IFSC code. If you like, you can also leave a message there. Simply click “Send Money” after you’ve entered that information

Step 6: When asked, press “Confirm Bank Transfer” to complete the process. The transaction report should appear on the next screen. That is all there is to it. You’ve completed the move.

Significant things to remember before you transfer your money from Paytm to a bank

- Any number between Rs. 100 and Rs. 25,000 can be sent.

- The minimum amount that can be transferred from your Paytm wallet to your bank account is Rs. 100.

- Both payments to a bank account are subject to a 5% conversion fee.

- You’ll need the account number, the IFSC code, and the name of the account holder.

Paytm Payments Bank was also released recently. Paytm offers a 7% interest savings account. A free digital debit card is also included with the Paytm savings account.

On online transactions, the Paytm debit card provides discounts and cashback. You can switch your wallet money to your Paytm Savings Account for free if you have one. You will then move money for free from your Paytm savings account to some other bank account.

On online transactions, the Paytm debit card provides discounts and cashback. You can switch your wallet money to your Paytm Savings Account for free if you have one. You will then move money for free from your Paytm savings account to some other bank account.

Add Comment