Credit cards are beneficiaries that will help you in emergencies and get great discounts on making payments. But at times they can cause a bit of trouble too, and it is fine to not want a credit card. So, here is a detailed procedure on how to cancel HDFC credit cards – step by step.

Steps on How to Cancel HDFC Credit Card

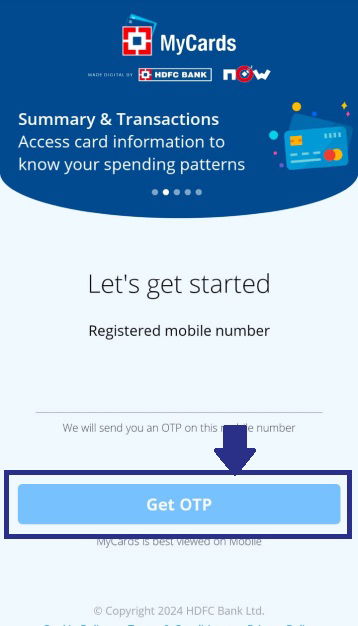

Step 1: Registered Phone number

Visit the mycards.hdfc.com page and add your 10-digit registered Mobile No attached to the HDFC credit card that you want to cancel.

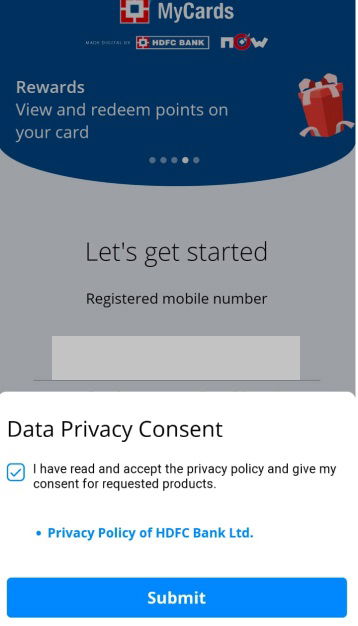

Step 2: OTP Verification

Input the OTP received on your mobile number tick the pop-up check box for privacy consent and click submit.

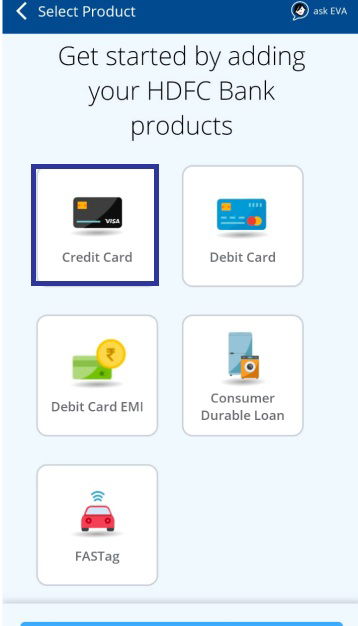

Step 3: Choose HDFC Credit Card

As HDFC provides several products you will be on the product window. Where you select the “credit card option. Selection of Product/Credit Card which you would like to close.

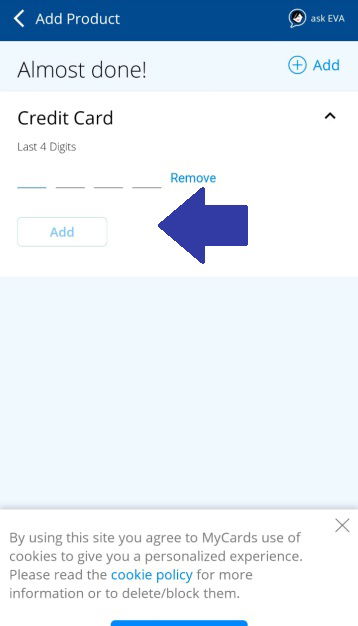

Step 4: HDFC Credit Card Cancellation Process

- Not registered for MyCards – Enter the last 4 digits of the Credit Card

- Multiple Credit Card holders – Select the card from the list or add the card if it was not registered.

- Single Credit card holder– proceed to the next step

Later you select the closure reason and authenticate with the OTP that you will receive on your registered mobile number. With that, you have now successfully submitted an HDFC Credit Card Closure request.

Note: An HDFC customer support engineer will reach out to you and take the process further to cancel your HDFC credit card.

Suggestive Read: How to Transfer Money From a Credit Card to a Bank Account

HDFC Customer Support Details

- HDFC Customer Support Number: 1800 1600 / 1800 2600

- Email: customerservices.cards@hdfcbank.com

Frequently Asked Questions

1. What is the required eligibility to apply for an HDFC Credit Card?

Eligibility to apply for an HDFC Credit Card typically requires being 21-60 years old, having a stable income, and having a good credit history.

2. How to check HDFC credit card application status?

Check HDFC credit card application status online via the HDFC Bank website or by contacting customer service with application details.

3. What are the different types of HDFC credit cards available?

HDFC offers various credit cards, including:

- Reward Cards: HDFC Regalia, HDFC MoneyBack.

- Travel Cards: HDFC Diners Club, HDFC Regalia First.

- Lifestyle Cards: HDFC Infinia, HDFC Millennia.

- Business Cards: HDFC Business MoneyBack.

- Co-branded Cards: HDFC JetPrivilege, HDFC IRCTC.

Each of these HDFC credit cards caters to specific needs and benefits.

4. How to activate an HDFC credit card?

To activate your HDFC credit card, call the customer care number or use HDFC net banking. Log in, select ‘Cards,’ then ‘Credit Cards,’ and choose ‘Activate Card.’ You can also activate it at an HDFC ATM by inserting the card and following the on-screen instructions.

5. How to increase the HDFC credit card limit?

To increase your HDFC credit card limit, log in to HDFC net banking, navigate to ‘Cards,’ then ‘Request,’ and select ‘Credit Limit Enhancement.’ Alternatively, email the bank or call customer service. You may need to provide income proof, such as salary slips or IT returns, for approval.

6. How to redeem HDFC credit card reward points?

To redeem HDFC credit card reward points, log in to HDFC NetBanking, go to ‘Credit Cards’ > ‘Redeem Reward Points,’ select your rewards, add them to your cart, and confirm the redemption. You can also redeem via the HDFC mobile app or contact customer service for assistance.

7. What to do if an HDFC credit card is lost or stolen?

If your HDFC credit card is lost or stolen, follow these steps:

1. Report Immediately: Call HDFC customer care to report the loss and block the card.

2. NetBanking: Log in to HDFC NetBanking, go to ‘Cards,’ select ‘Credit Cards,’ and choose ‘Report Lost/Stolen.’

3. Visit Branch: Alternatively, visit the nearest HDFC Bank branch to report the loss.

4. Police Report: File a police report if necessary, especially if you suspect theft or fraud.

5. Replacement: Request a replacement card from HDFC.

Monitor your account for unauthorized transactions and report any suspicious activity immediately.

Conclusion

Hopefully, you found the article informational and got the answers to how to cancel an HDFC credit card. Also, make sure you verify twice or thrice when sharing any bank-related information. Ensure it is always the HDFC support assistance and after confirmation only you share your personal information.

Add Comment