Want to take a loan to buy a new house, your dream car, or start your business? But your credit score doesn’t allow you to take a loan. Even if you are new to credit score or have been trying for some time to get that excellent credit score to get the benefits of a low-interest rate on a loan or credit card then here you can know how to check CIBIL score free and see where you credit score stand.

A good credit score will not only let you pay a high-interest rate but it can also affect your life in terms of getting a job, saving more on utilities, higher credit card limits, and a lot more

You will definitely get surprised by checking the benefits of credit score so for this

Also Read: Benefits of Good Credit Score

So How to Check Credit Score is the question?

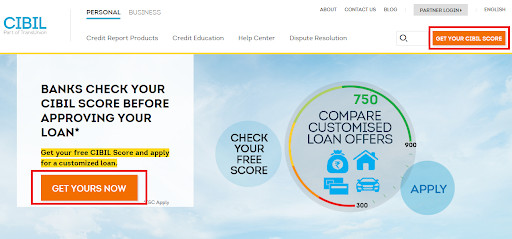

Step 1. Go to the CIBIL Website

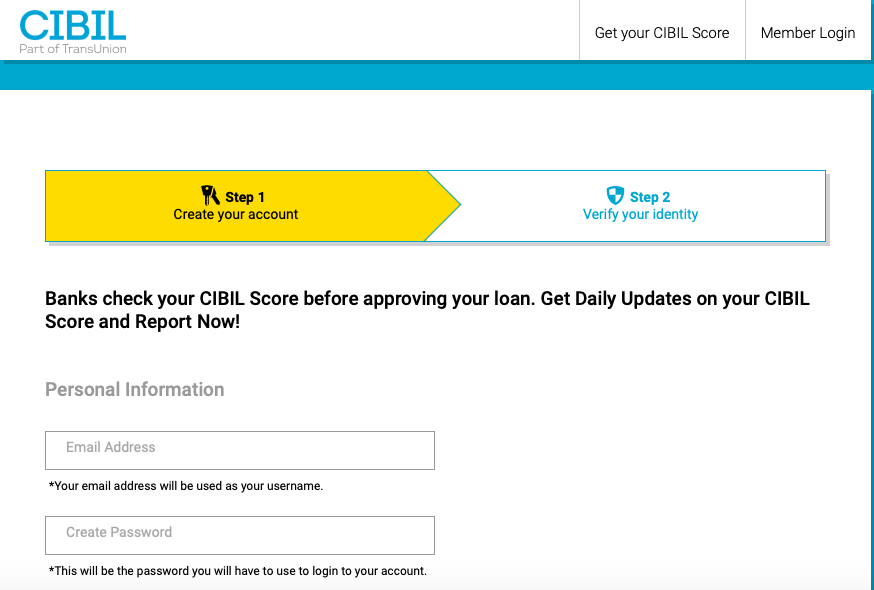

Fill in all the necessary information such as name, contact number, email address and click continue

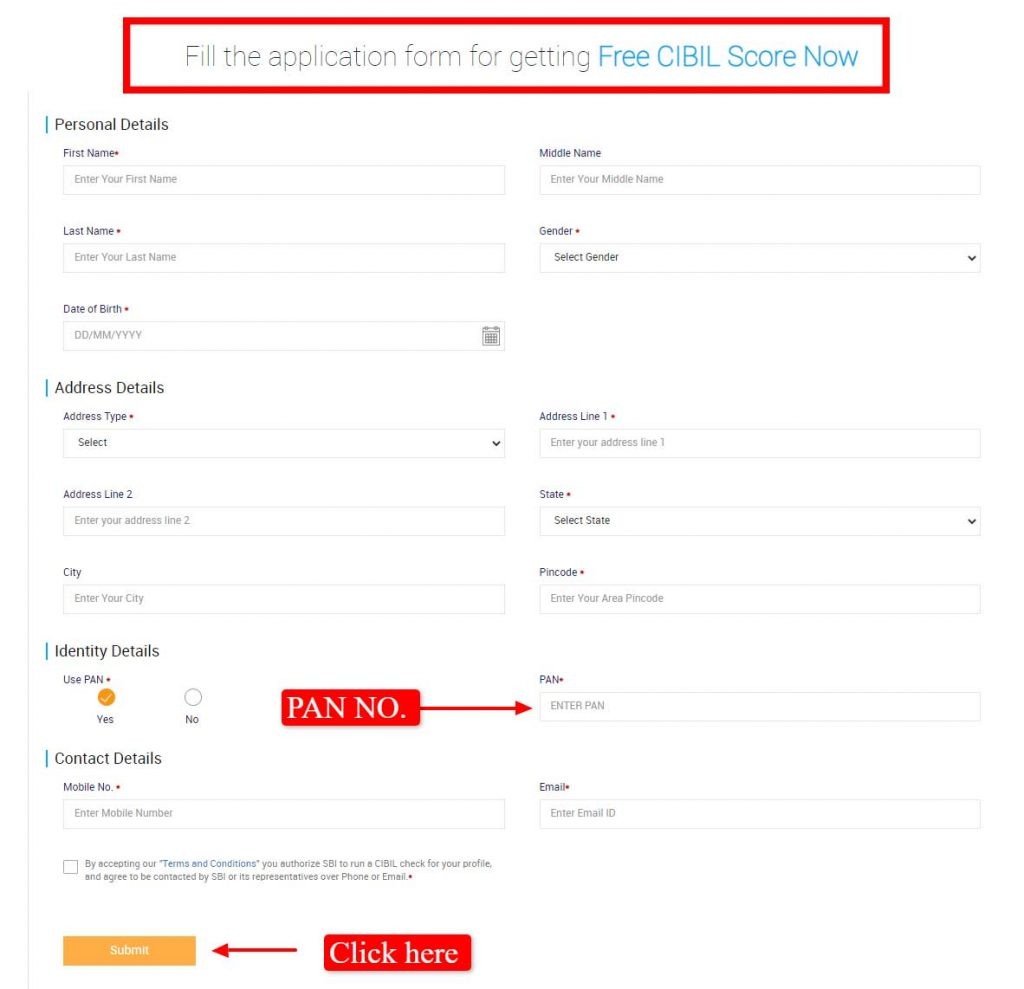

Step 2. Fill in additional information needed including your pan card. Make sure you fill right Pan Card number

Step 3. Answer all the questions about loans or credit cards based on which your credit score will be calculated.

However, you will be suggested various paid subscriptions ( if you need more than one CIBIL report in a year) but if you require only a one-time, free credit score and report then proceed and select no thanks at the bottom of the page

This is the point where an account is created and a confirmation message will receive by you

Now using your login and password in step 2. you can log in to your account

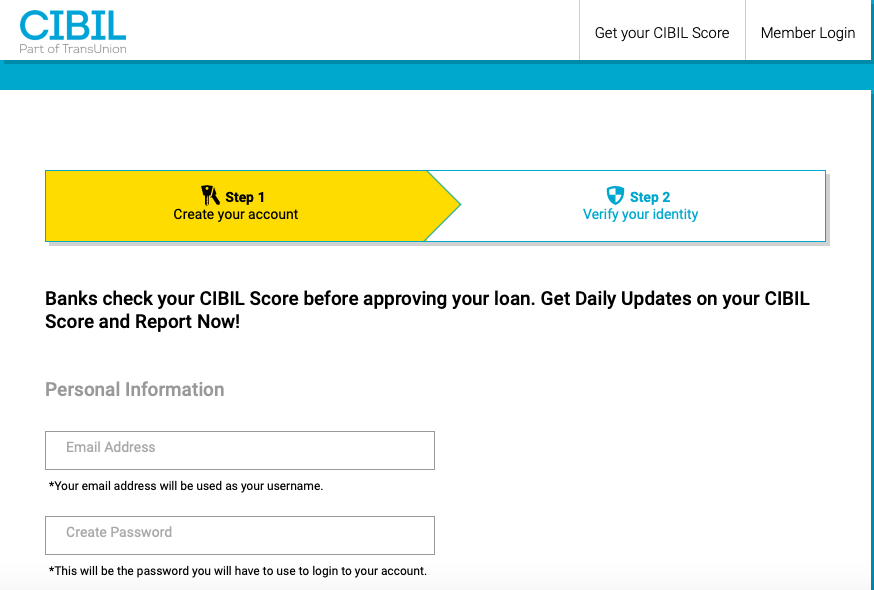

Step 4. To get going further, you need to authenticate yourself. You will receive an email. Click on the link and enter the one-time password provided in the email.

You will be prompted to change your password and login again.

Step 5. Once you log in all your personal details will be auto-populated by default( please provide accurate information if the fields are not populated) enter your number and click submit.

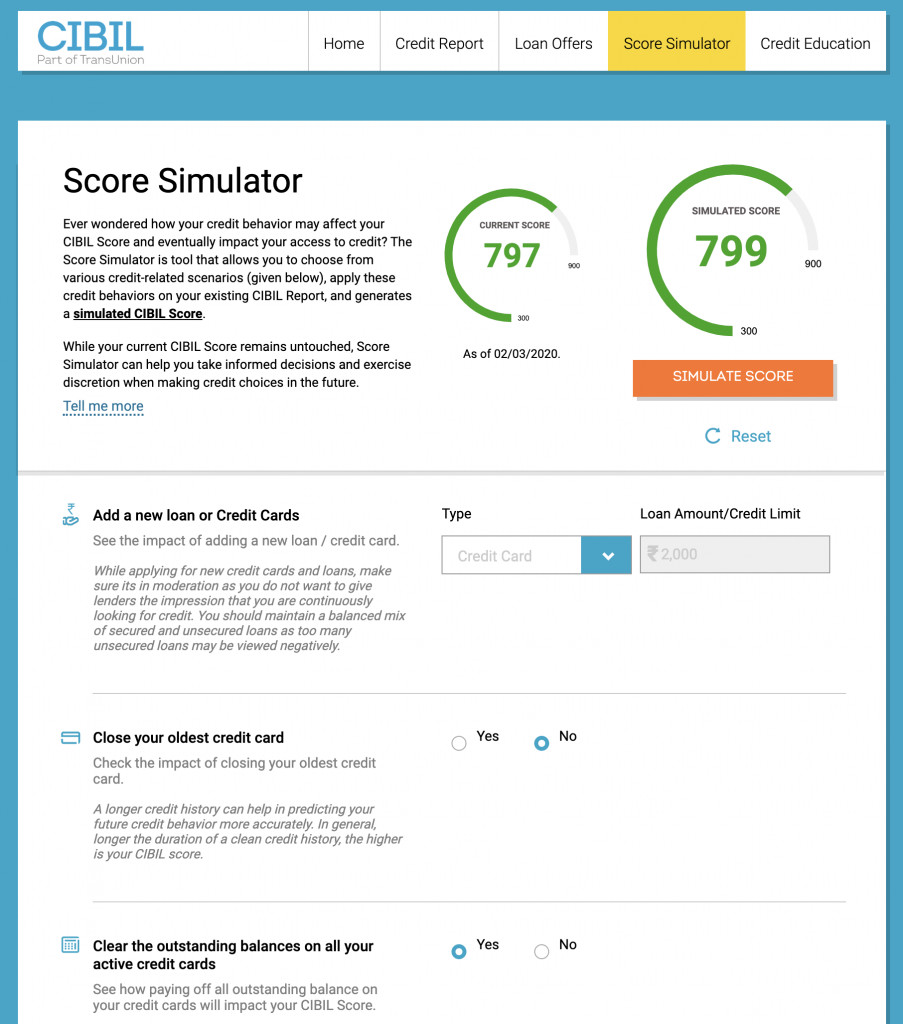

Once you submit that form your dashboard will revealed your CIBIL Score.

However, it is not ideal you check your credit score once, one needs to monitor all ups and down in credit report.

You can also get your credit report from agencies

- Experian

- Highmark

- Equifax

Based on the credit report by CIBIL, lenders analyze the credit history of the applicant and determine whether his/her suitability for a new loan or credit cards.

Add Comment